Updated Corporate Debt Margins (July 14, 2017)

Following are updated corporate debt margins for various maturities, updated weekly:

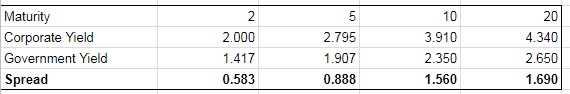

| Maturity | 2 | 5 | 10 | 20 |

| Corporate Spread | 0.583 | 0.888 | 1.560 | 1.690 |

Calculation Tutorial

Yahoo! Finance used to publish corporate and government yields for various maturities, which made the calculation very simple. We developed the Cost of Debt Calculator interface to match the data supplied by Yahoo! Finance. Unfortunately, they stopped publishing this data, so we must use a different source, which makes the calculation a bit longer. We will use data from the FRED Economic Database for the corporate yields, and from the US Department of Treasury for the government yields.

Following are the data sources:

| Website | Link |

| US Corporate 1-3 Year Effective Yield | https://fred.stlouisfed.org/series/BAMLC1A0C13YEY |

| US Corporate 3-5 Year Effective Yield | https://fred.stlouisfed.org/series/BAMLC2A0C35YEY |

| US Corporate 5-7 Year Effective Yield | https://fred.stlouisfed.org/series/BAMLC3A0C57YEY |

| US Corporate 7-10 Year Effective Yield | https://fred.stlouisfed.org/series/BAMLC4A0C710YEY |

| US Corporate 15+ Year Effective Yield | https://fred.stlouisfed.org/series/BAMLC8A0C15PYEY |

| US Treasury Yield Curve | https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield |

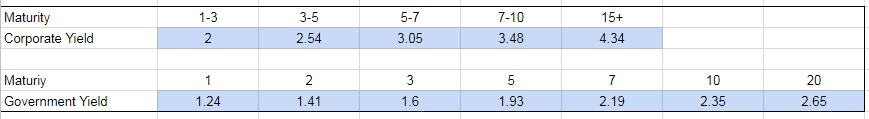

Using those data sources, create the following table in Excel:

Then, create a table with the maturities specified in the Cost of Debt Calculator interface (2,5,10,20):

To make the calculation consistent, following our suggested inputs:

- For the maturity of 2 years, use the 1-3 years corporate yield and the average of years 1, 2 and 3 for the government yield.

- For the maturity of 5 years, use the average yield of 3-5 and 5-7 maturities range for the corporate yield and the average of years 3, 5 and 7 for the government yield.

- For the maturity of 10 years, use the average yield of 3-5 and 5-7 maturities range for the corporate yield and the 10 year for the government yield.

- For the maturity of 20 years, use the 15+ maturity for the corporate yield and the 20 year for the government yield.