What is the Cost of Capital?

The cost of capital (WACC) of a company is used in valuation as the number used to discount the cash flows of the company to the present. It resembles all the risks associated with the cash flow produced by the company itself, before any financing considerations. Some of the risks represented by the WACC are operational, compliance, strategic, reputational, country, industry and so on. The cash flows produced by the company can be divided to different trenches of seniority.

For example, let's say a company produces between 80$ to 120$ per year, with an average of 100$. We can sell the "rights" for the first 40$. The probability that the cash flow in any given year will be less than 40$ is lower compared to the probability that it will be less than 100$. This means that the risk associated with not receiving those 40$ is less than the risk of the total cash flows of the company (WACC). So, we can sell the obligation for 40$ per year for a lower discount rate compared to the WACC. On the other hand, the risk of the remaining cash flows, above the first 40$, increases. If the range of cash flow before the trenching was 40% of the average, now the range is 40$ to 80$, a ratio of 66% to the average. This means that buyers will discount the remaining cash flow by a higher discount rate compared to the WACC. This is exactly how the cash flows of a company are divided between debt and equity. The debt has the seniority so it receives a relatively low interest rate, while the equity expects a much higher return. As you can see, the amount of debt, and correspondingly the amount of equity, affects their rates of return. If the company in our example needed to pay the debt holders an interest of 90$ a year, instead of 40$, the interest rate of the debt was much higher, close to the WACC, and the rate of return required by the equity holders also much higher because of the increased risk. On the other hand, if the debt was a very small amount, let's say, interest payments of 10$ annually, then the cost of debt was very low and the cost of equity also much lower, a bit above the WACC. Were are no universally optimal debt and equity ratios. The main reasons for that are different risks for various industries and companies, and different tax rates in various countries- interest payments are tax deductible.

Cost of capital calculation is often performed by using capital market parameters. Estimation of the cost of capital is a critical part of the valuation due to the high sensitivity of the valuation outcome to the cost of capital used.

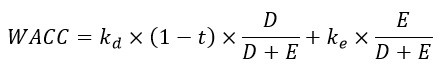

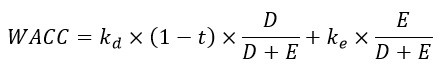

Since most companies are financed by both equity and debt, usually there is no parameter which estimates the cost of capital directly, so we must use an equation which combines the attributes of the various financing sources used. As a result, the cost of capital of a firm is the cost of its debt according to its weight in the capital structure and the cost of its equity according to its weight. The equation is:

Cost of Capital Calculation

Cost of capital calculation is often performed by using capital market parameters. Estimation of the Cost of Capital is a critical part of the valuation due to the high sensitivity of the valuation outcome to the cost of capital used.

Since most companies are financed by both equity and debt, usually there is no parameter which estimates the cost of capital directly, so we must use an equation which combines the attributes of the various financing sources used. As a result, the cost of capital of a firm is the cost of its debt according to its weight in the capital structure and the cost of its equity according to its weight. The equation is:

Where:

- Cost of Debt

- Cost of Equity

- Tax rate

D - Value of debt

E - Value of equity

In case the firm in financed by equity only, the left part of the equation is nullified and the WACC is equal to the Cost of Equity.

The tax rate is the effective tax rate which applies to the company and is used in the equation because finance expenses are tax deductible.

The value of debt is usually the sum of the financial debt as presented on the balance sheet or its intrinsic value, in case its interest rate is different from the marginal interest rate of the company.

The value of equity is the value attributed to the shareholders and there are several approaches to the number used. Some use the total equity as it appears in the balance sheet and some use the value of equity as calculated in the valuation. The most used approach is the calculated value (due to its consistency) but it creates a circular equation- the cost of equity affects the calculated value of equity which again affects the cost of equity. The way to calculate both the numbers is by trial and error. The use of the value of equity from the balance sheet is derived from the assumption that the management of the company examines the desirable leverage ratio by using the numbers in the financial statements and not from the market, which may flactuate.

The Cost of Debt is the rate of return required by the debt holders of the company, and represents the risks associated to the payment of the companys' debt.

The Cost of Equity is the rate of return required by the equity holders of the company, and represents the risks associated with the cash flows distributed to the equity holders of the firm.

Analystix Tools- Cost of Capital Calculator

The Cost of Capital Calculator found in the Analystix Tools package can help you easily calculate both the cost of equity and the weighted average cost of capital (WACC) and paste the calculation to Excel. It includes all the components needed for the calculation- beta, size premium and debt margin calculators, and links to online data sources with various input parameters used in the calculation.