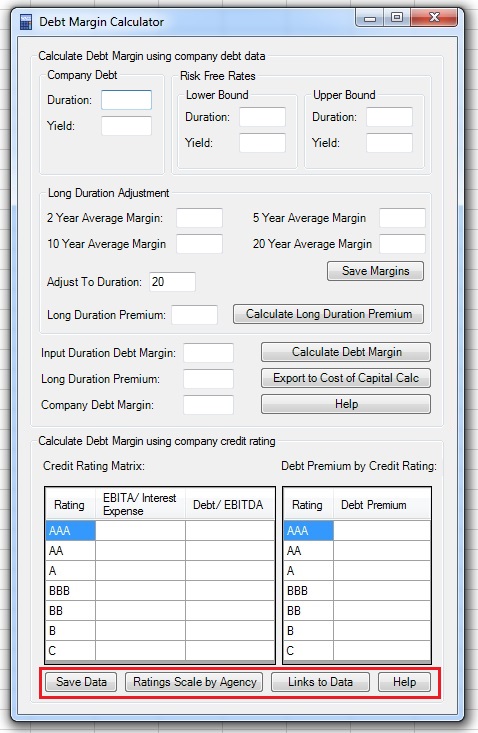

Debt Margin Calculator allows you to calculate the debt margin of the company by 2 methods:

- Use company debt characteristics to calculate the long term debt margin of the company.

- Use the credit rating characteristics of the company to find the long term debt margin of the company.

You can watch the tutorial video, read the step by step text tutorial or go through the step by step screenshots tutorial:

Step by Step Text Tutorial:

Calculating debt margin using company debt characteristics:

The calculator uses the duration and yield of 2 risk free bonds to calculate a yield curve. Then, it uses the yield curve and a duration and yield data of a debenture of the company to calculate the debt margin for the same duration.

1. Input the duration and current yield of a debenture of the company in the appropriate fields in the Company Debt section.

2. Input the the duration and yield of 2 risk free bonds in the appropriate fields in the Risk Free Rates section. It is best to use two bonds which duration is close to that of the company, one a bit lower and one a bit higher compared to the input of the debenture of the company.

3. You can calculate the debt margin for the duration you entered in section 1 by clicking on “Calculate Debt Margin” button. It is also possible to adjust the margin to the duration of the equity (mostly between 17 to 22 years)- corporate debt margins tends to increase when duration rises. In order to do this, you need to input the average debt margins of corporate debentures compared to risk free rates for a duration of 2, 5, 10 and 20 years in the appropriate fields in the Long Duration Adjustment section. You can calculate this using data found on Yahoo! Finance (click here for a guide). You can save this data by clicking on the “Save Margins” button, and it will appear the next time you will activate the Debt Margin Calculator.

4. If the corporate debt margins for various durations data exists, enter the long term duration you want to adjust to in the "Adjust To Duration" field (the default is 20 years) and click on “Calculate Long Duration Premium” button. The long duration adjustment premium, based on the duration of the debenture you entered in section 1, will appear in the "Long Duration Premium" fields.

5. Click on “Calculate Debt Margin” button and you will see the debt margin calculation output in the appropriate fields. You can click on the “Export to Cost of Capital Calc” button to copy the debt margin to the "Debt Margin" field in the Cost of Capital Calculator window.

Calculating debt margin using company debt characteristics:

If you don’t have the characteristics of a debenture of the company, you can use other characteristics of the company to calculate its debt margin. If you know the credit rating of the company, you can find the average debt margin of companies with the same rating. If the company does not have a credit rating, you can use the EBITA to Interest Expense and Debt to EBITDA ratios to find the potential credit rating of the company.

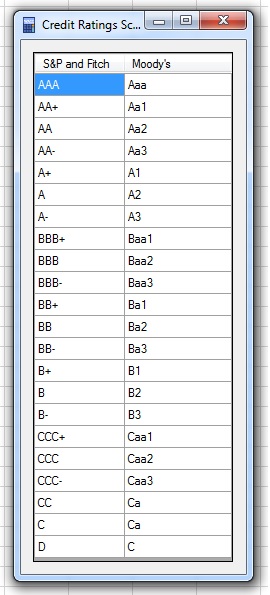

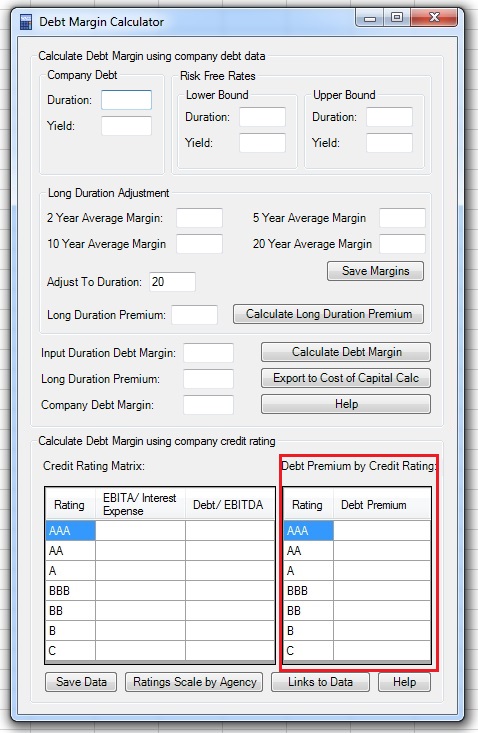

Debt Margin Calculator includes two data tables for those calculations: Credit Rating Matrix and Debt Premium by Credit Rating. You can find the data to populate those tables if you click on the “Links to Data” button. Once you populate the tables, click on the “Save Data” button and it will be loaded the next time you activate the Debt Margin Calculator. You can also click on “Rating Scale by Agency” for a list of credit ratings of the major 3 credit rating agencies.

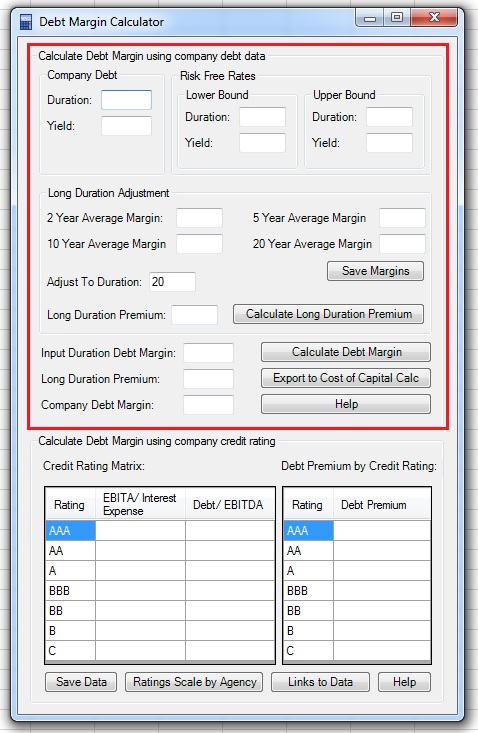

Step by Step Screenshots Tutorial:

Calculating debt margin using company debt characteristics:

The calculator uses the duration and yield of 2 risk free bonds to calculate a yield curve. Then, it uses the yield curve and a duration and yield data of a debenture of the company to calculate the debt margin for the same duration.

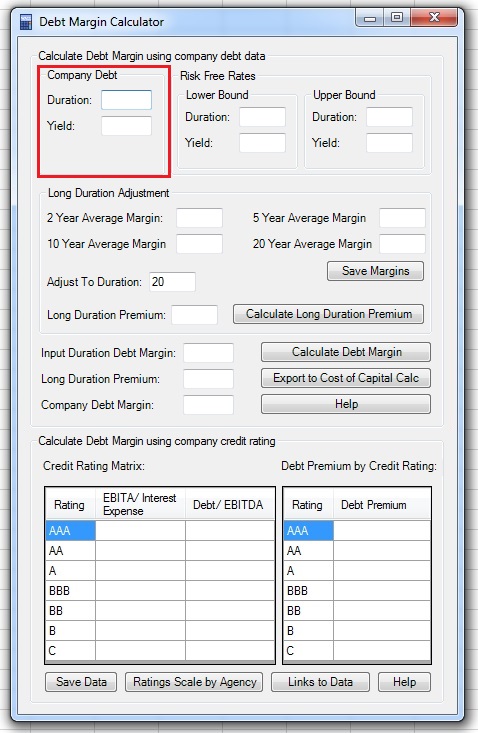

1. Input the duration and current yield of a debenture of the company in the appropriate fields in the Company Debt section.

2. Input the the duration and yield of 2 risk free bonds in the appropriate fields in the Risk Free Rates section. It is best to use two bonds which duration is close to that of the company, one a bit lower and one a bit higher compared to the input of the debenture of the company.

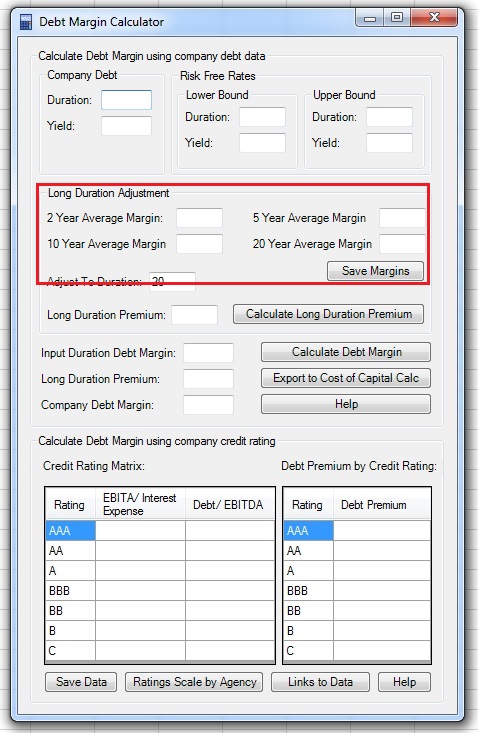

3. You can calculate the debt margin for the duration you entered in section 1 by clicking on “Calculate Debt Margin” button. It is also possible to adjust the margin to the duration of the equity (mostly between 17 to 22 years)- corporate debt margins tends to increase when duration rises. In order to do this, you need to input the average debt margins of corporate debentures compared to risk free rates for a duration of 2, 5, 10 and 20 years in the appropriate fields in the Long Duration Adjustment section. You can calculate this using data found on Yahoo! Finance (click here for a guide). You can save this data by clicking on the “Save Margins” button, and it will appear the next time you will activate the Debt Margin Calculator.

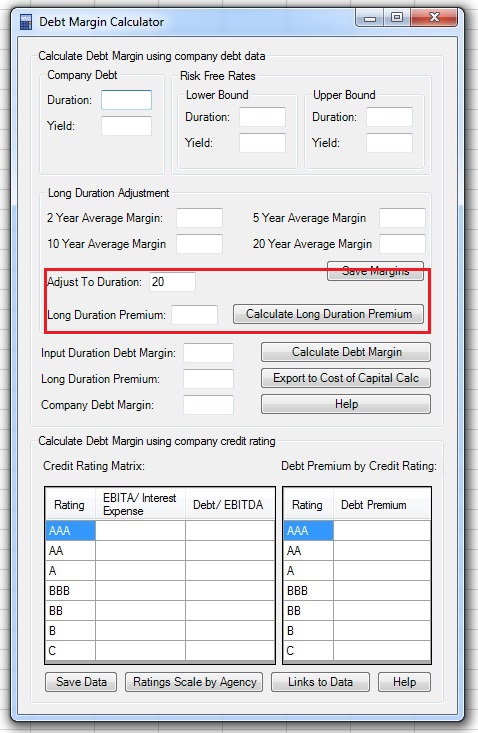

4. If the corporate debt margins for various durations data exists, enter the long term duration you want to adjust to in the "Adjust To Duration" field (the default is 20 years) and click on “Calculate Long Duration Premium” button. The long duration adjustment premium, based on the duration of the debenture you entered in section 1, will appear in the "Long Duration Premium" fields.

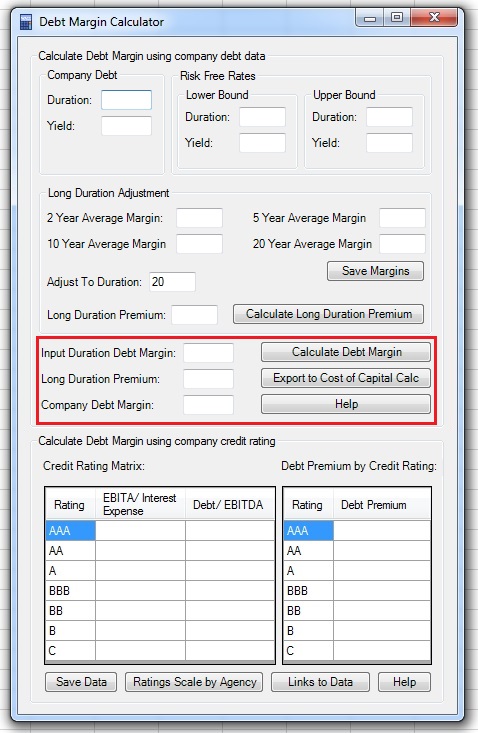

5. Click on “Calculate Debt Margin” button and you will see the debt margin calculation output in the appropriate fields. You can click on the “Export to Cost of Capital Calc” button to copy the debt margin to the "Debt Margin" field in the Cost of Capital Calculator window.

Calculating debt margin using company debt characteristics:

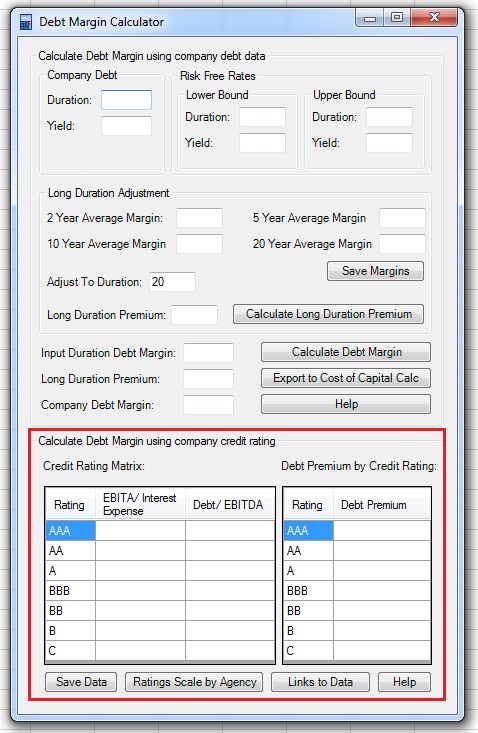

If you don’t have the characteristics of a debenture of the company, you can use other characteristics of the company to calculate its debt margin. If you know the credit rating of the company, you can find the average debt margin of companies with the same rating. If the company does not have a credit rating, you can use the EBITA to Interest Expense and Debt to EBITDA ratios to find the potential credit rating of the company.

Debt Margin Calculator includes two data tables for those calculations: Credit Rating Matrix and Debt Premium by Credit Rating:

You can find the data to populate those tables if you click on the “Links to Data” button. Once you populate the tables, click on the “Save Data” button and it will be loaded the next time you activate the Debt Margin Calculator. You can also click on “Rating Scale by Agency” for a list of credit ratings of the major 3 credit rating agencies.