Beta Calculator allows you to calculate the Beta of the company in 3 methods:

- Regression coefficient of the company stock returns and stock market returns.

- Levering the unlevered industry Beta using the leverage and tax rate of the company.

- Calculating the average or median unlevered Beta of peer companies and leveraging it using the leverage and tax rate of the company.

You can watch the tutorial video, read the step by step text tutorial or go through the step by step screenshots tutorial:

Step by Step Text Tutorial:

Calculating the regression Beta of the company:

1. Select a range of stock returns/prices by clicking on the “Stock Returns Range” field, selecting the range in the spreadsheet and returning to the Beta Calculator window. Note that you must select one row or one column containing a range of prices or returns.

Note: If the range input field is not empty, you need to delete existing text before selecting a new range in the spreadsheet.

2. Select a range of market returns/prices by clicking on the “Market Returns Range” field, selecting the range in the spreadsheet and returning to the Beta Calculator window. Note that you must select one row or one column containing a range of prices or returns.

Note: If the range input field is not empty, you need to delete existing text before selecting a new range in the spreadsheet.

3. Click on the “Calculate Beta” button in the Stock Market Beta Calculation section.

4. The Beta, R Squared and data input type will appear in the appropriate fields in the Stock Market Beta Calculation section. Make sure that the input type is correct (prices/returns). Now, you can click on the “Export Beta to Cost of Capital Calculator” button to copy the beta to the "Beta" field in the Cost of Capital Calculator.

Calculating the Beta of the company using industry unlevered Beta:

1. Input the industry unlevered Beta, company tax rate and the equity to capital ratio of the company in the appropriate fields in the Industry Beta Calculation section. You can find unlevered Beta of the industry data in Damodaran’s website.

2. Click on the “Calculate Beta” button in the Industry Beta Calculation section and the Beta of the company will appear in the appropriate field. You can click on the “Export Beta to Cost of Capital Calculator” button to copy the beta to the "Beta" field in the Cost of Capital Calculator.

Calculating the Beta of the company using the Beta of peer companies:

You can create a list of peer companies using their levered beta, tax rate and equity/capital ratios. Beta Calculator will calculate the unlevered Beta of each peer company and the average and median unlevered Betas of the list. Then, you can use the average or median Beta as the unlevered industry Beta and compute the Beta of the company.

1. Input the name, levered Beta, effective tax rate and equity to capital ratio of a peer company in the appropriate fields under the Peer data for industry unlevered beta calculation section.

2. Click on the “Add To List” button and you will see the data you entered added to the list, including the calculated unlevered beta. Using the same method, add all the relevant peer companies. You can also delete companies from the list by clicking on the company in the list and on the “Delete From List” button.

3. You will see that Beta Calculator computes the average and median Betas of for the companies entered as you update the list. You can click on the “Use Average Beta” or “Use Median Beta” buttons to export the unlevered Beta to the "Industry Unlevered Beta" field. Then, input the tax rate and equity/capital ratio of the company to calculate its Beta.

4. If you want, you can export the list of peer company data to the Excel speadsheet by clicking on the “Output Cell” field, clicking on the cell in the spreadsheet and returning to the Beta Calculator window, and clicking on the “Export company list to sheet” button.

Step by Step Screenshots Tutorial:

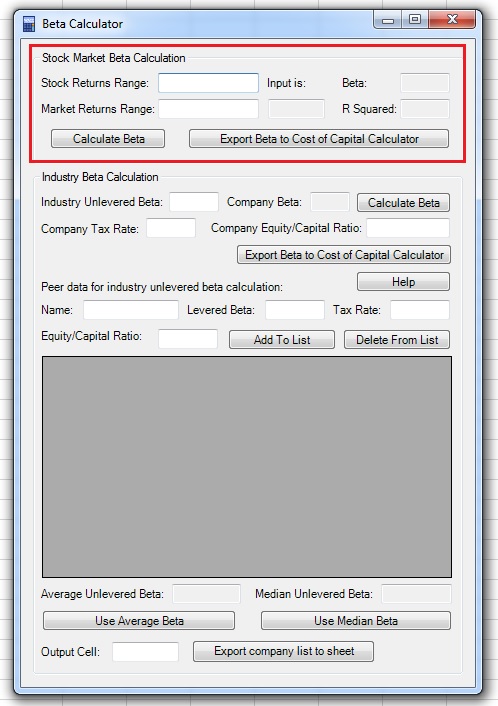

Calculating the regression Beta of the company:

1. Select a range of stock returns/prices by clicking on the “Stock Returns Range” field, selecting the range in the spreadsheet and returning to the Beta Calculator window. Note that you must select one row or one column containing a range of prices or returns.

Note: If the range input field is not empty, you need to delete existing text before selecting a new range in the spreadsheet.

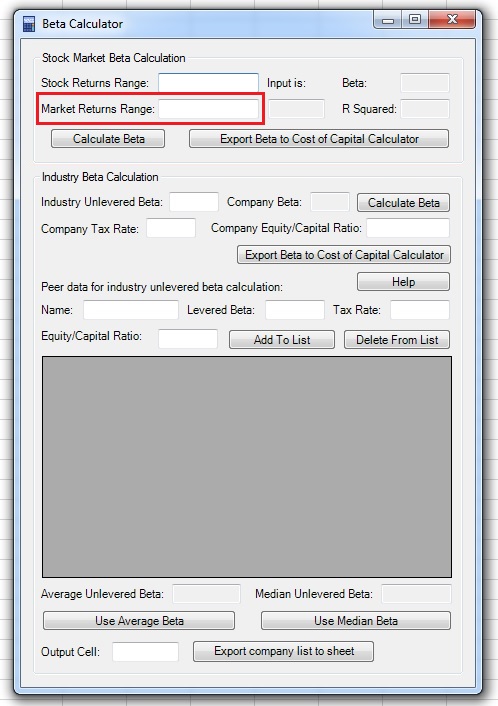

2. Select a range of market returns/prices by clicking on the “Market Returns Range” field, selecting the range in the spreadsheet and returning to the Beta Calculator window. Note that you must select one row or one column containing a range of prices or returns.

Note: If the range input field is not empty, you need to delete existing text before selecting a new range in the spreadsheet.

3. Click on the “Calculate Beta” button in the Stock Market Beta Calculation section.

4. The Beta, R Squared and data input type will appear in the appropriate fields in the Stock Market Beta Calculation section. Make sure that the input type is correct (prices/returns). Now, you can click on the “Export Beta to Cost of Capital Calculator” button to copy the beta to the "Beta" field in the Cost of Capital Calculator.

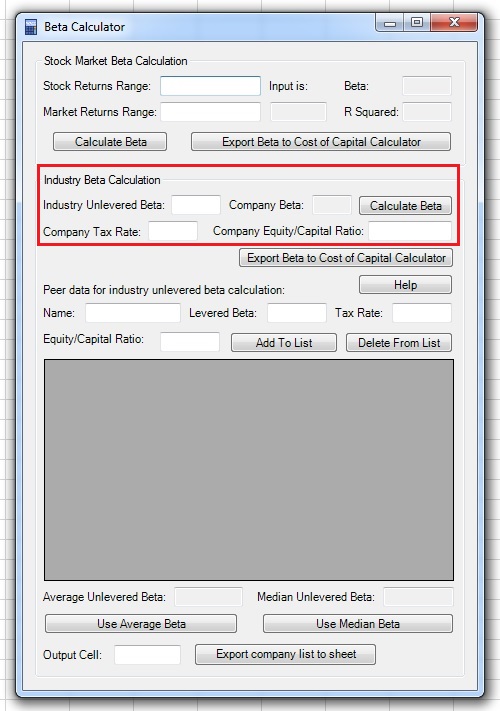

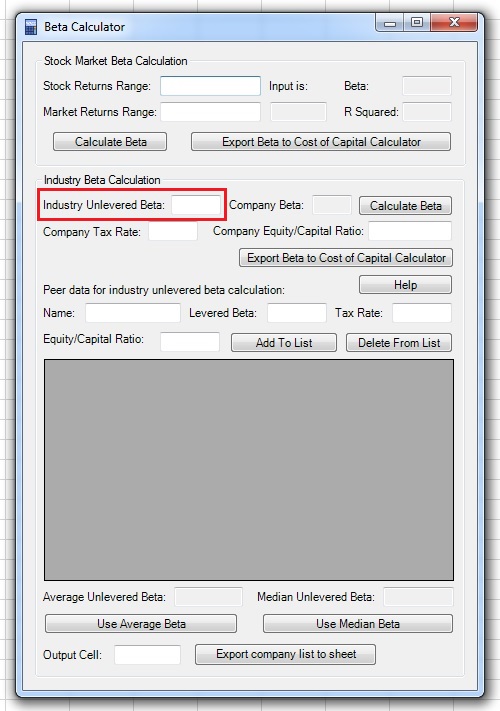

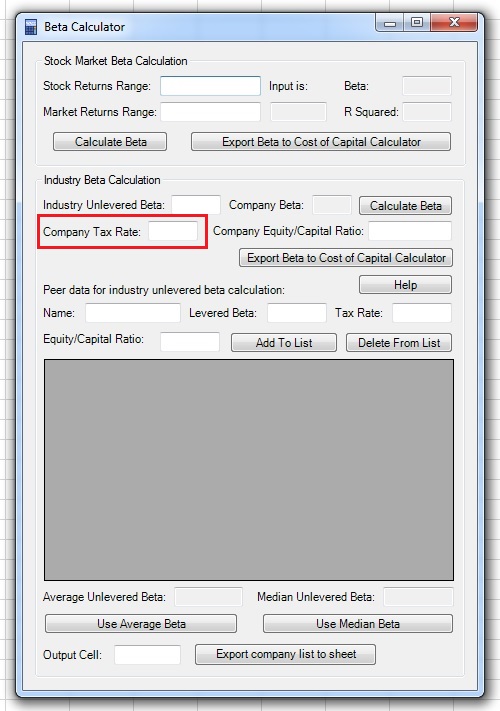

Calculating the Beta of the company using industry unlevered Beta:

1. Input the industry unlevered Beta, company tax rate and the equity to capital ratio of the company in the appropriate fields in the Industry Beta Calculationsection. You can find unlevered Beta of the industry data in Damodaran’s website.

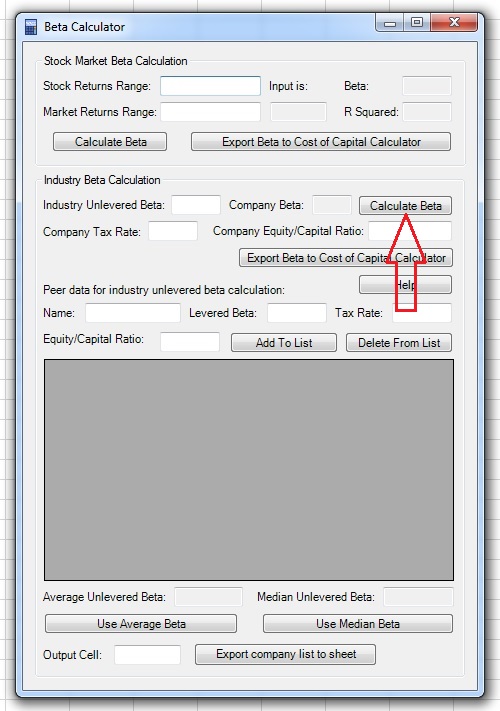

2. Click on the “Calculate Beta” button in the Industry Beta Calculation section and the Beta of the company will appear in the appropriate field. You can click on the “Export Beta to Cost of Capital Calculator” button to copy the beta to the "Beta" field in the Cost of Capital Calculator.

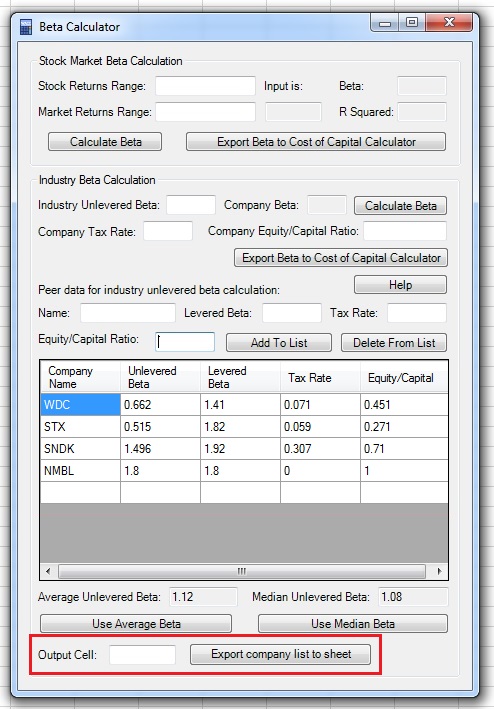

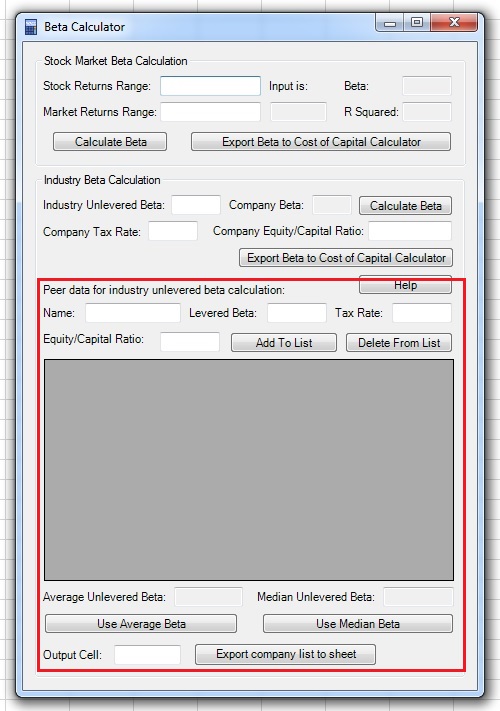

Calculating the Beta of the company using the Beta of peer companies:

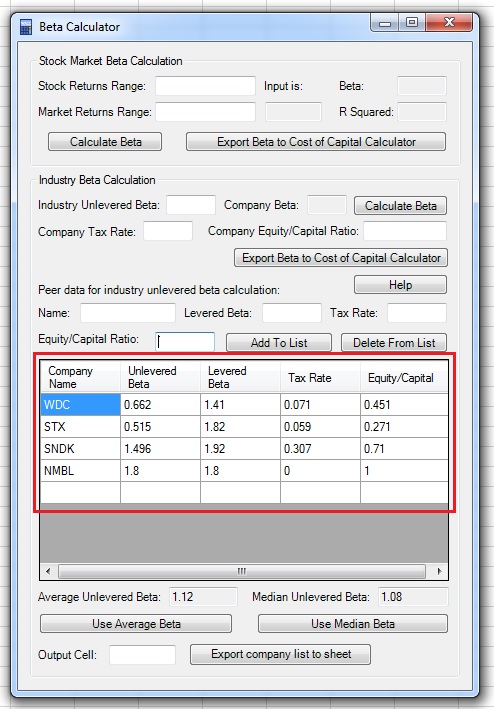

You can create a list of peer companies using their levered beta, tax rate and equity/capital ratios. Beta Calculator will calculate the unlevered Beta of each peer company and the average and median unlevered Betas of the list. Then, you can use the average or median Beta as the unlevered industry Beta and compute the Beta of the company.

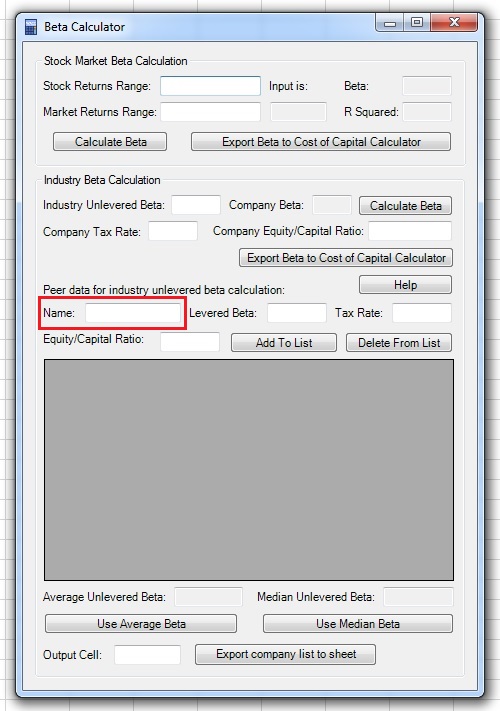

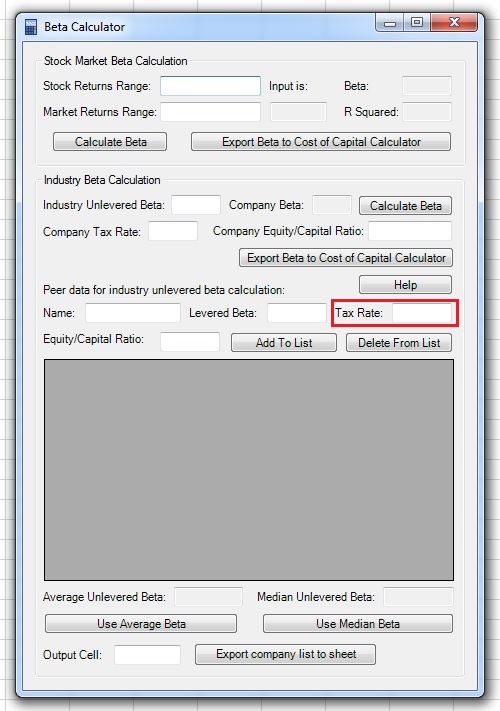

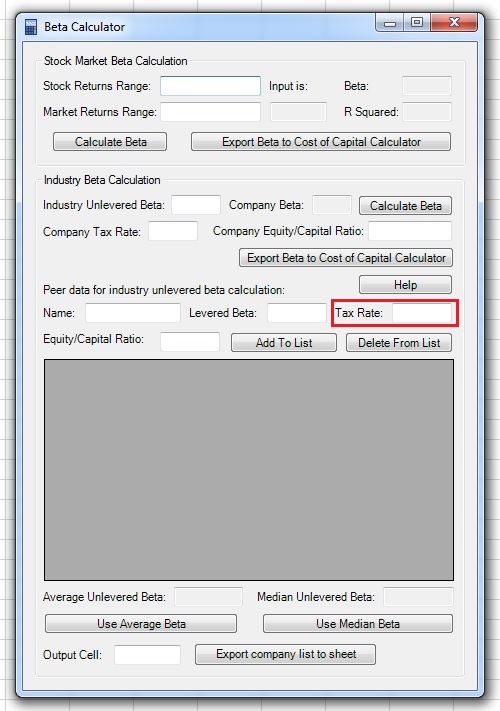

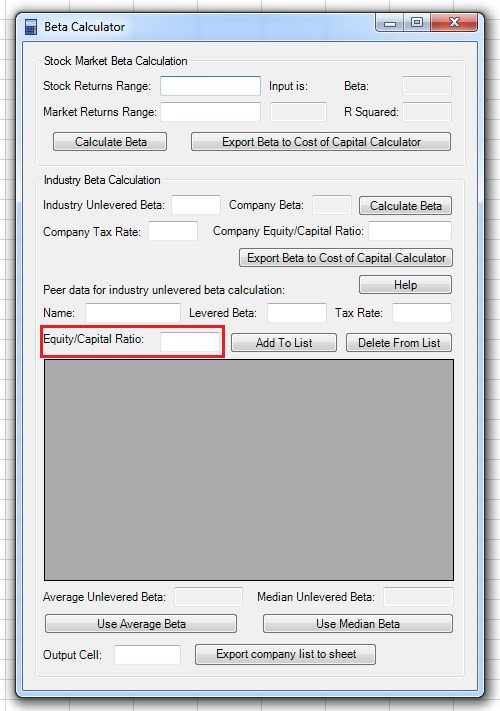

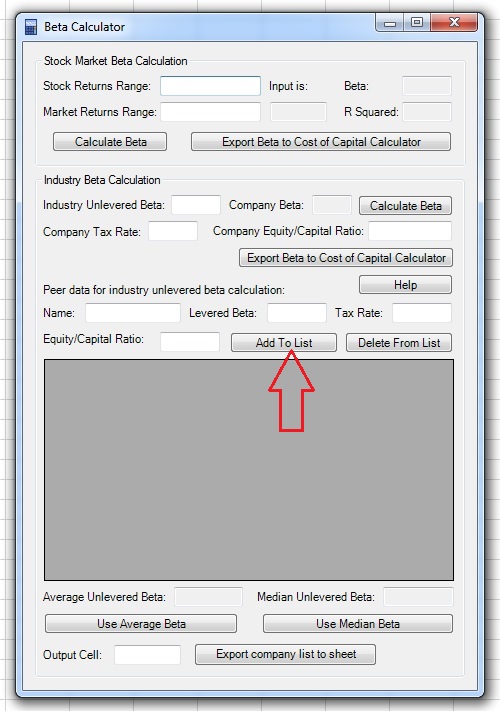

1. Input the name, levered Beta, effective tax rate and equity to capital ratio of a peer company in the appropriate fields under the Peer data for industry unlevered beta calculation section.

2. Click on the “Add To List” button and you will see the data you entered added to the list, including the calculated unlevered beta. Using the same method, add all the relevant peer companies. You can also delete companies from the list by clicking on the company in the list and on the “Delete From List” button.

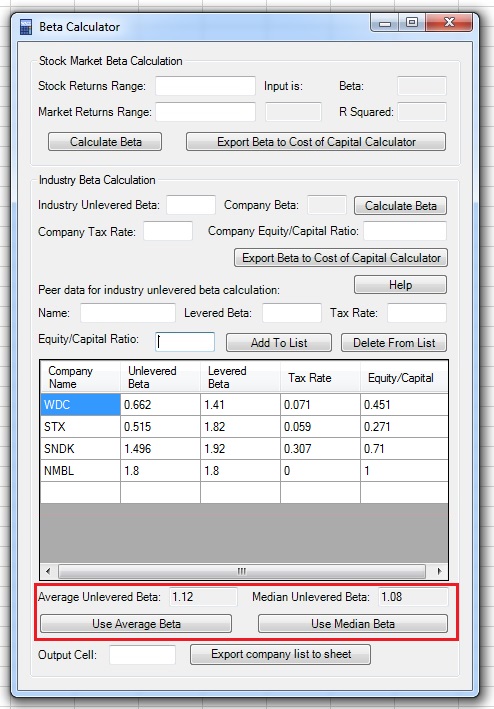

3. You will see that Beta Calculator computes the average and median Betas of for the companies entered as you update the list. You can click on the “Use Average Beta” or “Use Median Beta” buttons to export the unlevered Beta to the "Industry Unlevered Beta" field. Then, input the tax rate and equity/capital ratio of the company to calculate its Beta.

4. If you want, you can export the list of peer company data to the Excel speadsheet by clicking on the “Output Cell” field, clicking on the cell in the spreadsheet and returning to the Beta Calculator window, and clicking on the “Export company list to sheet” button.