What is the Cost of Equity?

The Cost of Equity represents the risk of the cash flow to the shareholders of a company. It is the risk of the cash flow available to distribution to the shareholders of the company, after the payments made to the debt holders. In case the company does not have outstanding debt and is financed solely by equity, the Cost of Equity is identical to the Cost of Capital of the company. Therefore, with debt, the risk is similar to the risk of the total cash flows generated by the company, with two modifications: financial risk and leverage affect. Cost of Equity calculation is often performed by adjusting Cost of Capital of the company to its leverage.

Financial risk is the risk that the company will not be able to pay its debt and will default. It is the risk that the equity holders will loose a material part of their holdings in the equity, for example, due to a dilution caused by a debt restructuring process. The higher the debt compared to equity, the higher the financial risk since a smaller decline in cash flows or company value can lead to a default.

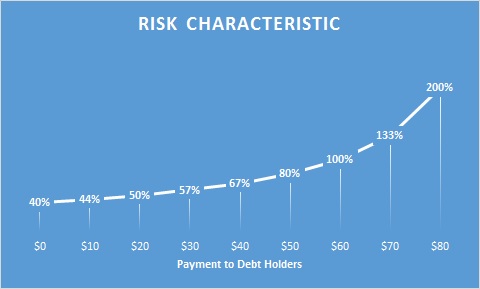

The leverage affect relates to the increase in the volatility of cash flows to equity as leverage rises. For example, think about a company which generates between 80$ to 120$ annually. The average cash flow is 100$ so we can deduce a risk characteristic which is based on the possible range of cash flows compared to the average cash flow, in this case, 40% (range of 120$-80$=40$, divided by the average of 100$). Now, let's say that the leverage is relatively low and the payments to the debt holders are only 20$ annually. This means that the cash flows to equity holders would be in the range of 60$ to 100$. In this case, the risk characteristic which we calculated earlier will be 50%. If the company has a high leverage, lets say, annual payment to debt holders of 60$, the range of cash flows to equity declines to 20$ to 60$, a risk of 133%. Here is a chart which shows our risk characteristic according to the payment to debt holders:

What we have seen here is that the risk of equity cash flows is dependent on the same characteristics as the risk of the cash flows of the company, but the volatility compared to average, or expected, cash flows is increased with leverage. So, to sum it up, the leverage affect is the increased volatility of the risks of the company which depends on its' leverage.

As we have seen, both the financial risk and the leverage affect are positively linked to the leverage of the company. As equity to capital ratio decreases, the more cash flows generated by the company are distributed to the debt holders and the financial risk and leverage affect increase.

Cost of Equity formula

The Cost of Equity calculation is performed by adding a risk premium to the long term risk free rate. I’ll explain the risk premium calculation based on the SML (Security Market Line) equation which is derived from the CAPM (capital asset pricing model). The SML is computed by using the behavior of the price of the stock relative to the behavior of the market as represented by the regression coefficient of those two parameters. The equation is:

Where:

- Long term risk free rate

- Beta, represents the relative risk of the stock relative to the market

- Market risk premium

Long term risk free rate

The risk free rate is the minimum return available in the market. This return is available by investing in almost risk free securities- mostly government bonds. Since government bonds are the closest representatives of risk free securities, their returns used in calculations which require a risk free rate. The two parameters which help us decide which government bond to use in the calculation are duration and inflation linkage.

The duration which should be used is the duration of the equity, which is mostly estimated to be between 17 to 22 years. In the past it was customary to use 10 year bonds but due to the steepness of the yield curve in recent years and because the average duration of the cash flows is around 17-22, I think it’s better to use bonds with a duration of approximately 20 years.

Inflation linkage appears in the terms of the bond- nominal or inflation linked. For example, the U.S. government issues two kinds of bonds, Nominal and TIPS (Treasury Inflation Protected Securities). We need to check if the cash flow forecast used in the valuation is in nominal or real terms. In case the revenues were assessed only on the basis of change in quantity, the forecast is usually in real terms. If a change in price was taken into account it is usually in nominal terms. The government bond which we’ll use should be consistent with the assumption of the cash flow forecast, hence, nominal bond for nominal forecast and inflation adjusted bond for a real forecast.

Market risk premium

The market premium is the spread between the long term average market yield and the long term risk free rate. It represents the premium of the stock market yield over the risk free rate and is usually based on historical statistics. In the U.S., it is estimated to be between 4% to 6% while in developing markets it tends to be higher. It can also be estimated by using the implied premium which is calculated by using the current price, free cash flow and expected growth rates (you can finds the data and explanation in Damodaran’s website).

Beta

Regression Beta Estimation

The Beta represents the relative risk of the specific stock relative to the risk of the whole market. The beta is calculated by estimating the regression coefficient of the yield of the stock as the dependent variable and the yield of the market as the independent variable. The result is the average ratio of the change in the price of the stock relative to the change in price of the market. For example, a beta of 1.5 means that on average, when the market rises by 2% the stock price will increase by 3%. The conclusion is that a beta higher than 1 means that the stock is more volatile than the market and the opposite. If we assume that volatility represents risk we can see that a beta larger than 1 means that the risk of the cash flow to the shareholders is higher than the average risk in the market. It can mean that the risk of the company itself is higher than the market, that the risk of the leverage is higher than the market or both. The Beta Calculator found in the Cost of Capital Calculator, part of the Analystix Tools Excel Add-ins package, allows to easily estimate the regression beta of a company in Excel.

You can view a more thorough article on Beta Calculation.

In Beta calculation we use several inputs which may affect the result drastically:

Data period- we can use price data from the last year, last 3 years, last 5 years and every other time period. The leading rule is that the time period used should be as long as possible but representative of the business environment and current company operations. Since by using historical data we presume that the historic beta represents the future beta we will aspire that the duration used will represent the operation of the company now and in the future. Therefore, if 2 years ago the regulation in the industry of the company analyzed changed significantly, a calculation based on data of the last 5 years will be a worse representative of the future compared to last 2 years data.

Frequency of the data- We can use daily, weekly, monthly and so on yields as the inputs to the regression. I think it’s best to use weekly or monthly periods since those frequencies usually give you enough observations and not suffer from the effect of low liquidity which reduces the beta.

The Market- since the independent variable in the regression is the stock market, we will use the market in which the company operates. For example, for a U.S. company we will probably use the S&P500 while for a South Korean company we’ll use the KOSPI index.

Company Beta Estimation

The customary practice is not to use the specific beta of the company analyzed but the average beta of companies in the same industry, adjusted to the leverage of the company. The use of the industry beta is based on the assumption that while the market might be wrong in pricing a single company, it is likely to be correct in estimating the risk of an industry. We estimate that the risk of the industry is closely related to the risk of the company and represents its' Cost of Capital, so by levering it we can deduce the Cost of Equity. The calculation of the leverage adjusted beta is based on a calculation of the unlevered beta of similar companies by using an equation named “Hamada Equation”. In this case, it is important to check if the companies used in the calculation of the average are indeed similar companies to the one analyzed. The Beta Calculator allows you to easily create a list of peer companies and calculate their average and median unlevered beta.

Hamada Equations:

where

- Value of debt

- Value of equity

First we calculate the regression beta of similar companies, then calculate the unlevered beta using the equation and calculate the average or median unlevered beta. Then we calculate the levered beta using the parameters of the company analyzed.

Additional premiums

Size Premium- Several studies showed that small companies (in market cap terms) tend to present higher yields than those calculated by the SML equation. Ibbotson and Duff & Phelps publish data which describes the premium to the cost of equity (calculated by the SML equation) by market cap. The Size Premium Calculator, found in the Cost of Capital Calculator, part of the Analystix Tools Excel Add-ins package, allows to easily save size premium data for use in the Cost of Capital calculation in Excel.

Specific Risk Premium- You can add a specific premium if you think that the risk which is represented by the beta (of the company or the industry) is not a good representative of the future risk of the company. There is no specific guidance as to the exact premium to use but the reason for using it should be well explained and consistent. The explanation should describe the reasons why the beta used does not represent the future risk reliably. For example, if the beta is calculated using data from the last 3 years and a regulatory change is anticipated in the industry in a few months, a specific premium should be used. Another example would be a use of beta based on the average beta of the industry while assuming that the company analyzed has a specific risk which is unique to her. Although there is no guiding rule as to the exact premium to use you can check if the anticipated changes happened in the past or in another industry and the influence of those changes on the beta in those periods/industries.